Common Credit Issues We Fix

- Late payments—Late payments can have a serious impact on your credit score, especially if they’re 30 days or more past due. At Global Credit, we work to identify these issues, dispute inaccurate reports, and guide you on how to avoid them in the future.

- Charge-offs—A charge-off happens when a creditor gives up on collecting a debt, but it doesn’t disappear from your credit report. We help you challenge charge-offs that may be outdated, inaccurate, or unverifiable, improving your chances of approval for future credit.

- Collections—Accounts sent to collections can tank your score. We contact collection agencies and credit bureaus directly to resolve disputes and request removals when appropriate, while also helping you build strategies for debt repayment.

- Repossessions—Vehicle repossessions can remain on your report for years, hurting your chances for future loans. Our team works to validate the accuracy of repossession records and negotiate removals or adjustments where possible.

- Bankruptcy items—While bankruptcies are legal filings, errors in how they appear on your credit report are common. We ensure your bankruptcy details are reported correctly and work to eliminate outdated or duplicate entries to help you move forward financially.

- Identity theft issues—Fraudulent accounts and hard inquiries from identity theft can destroy your credit. We offer comprehensive support to clean up your report, dispute false items, and secure your profile moving forward.

Credit Repair Expertise

At Global Credit, we understand the complexities of the credit system and how different lenders and bureaus operate. Our St. Louis MO team brings deep insight into how credit unions, banks, and reporting agencies work, allowing us to anticipate challenges and craft effective solutions. From medical collections to reporting errors, we know how to identify issues and guide clients through the resolution process.

Over the years, Global Credit has built strong relationships with financial professionals and institutions, giving our clients access to tailored strategies that deliver real results no matter where they are.

Our Proven 4-Step Process

Step 1: Free Consultation

We begin with a no-obligation consultation to understand your current credit challenges and financial goals. This is your opportunity to ask questions and learn how we can help repair your credit.

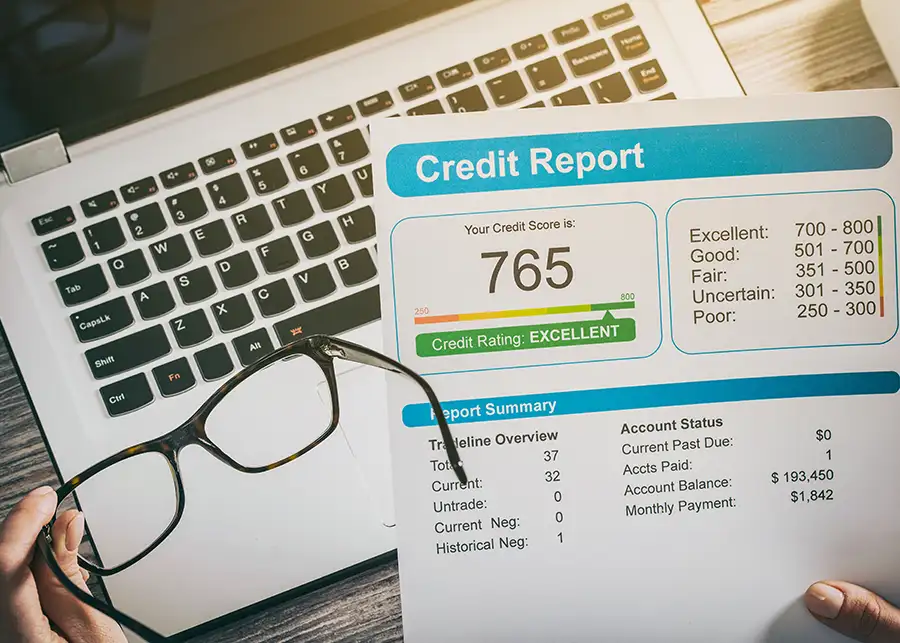

Step 2: Credit Report Analysis

Our team conducts a detailed review of your credit reports from all three major bureaus—Equifax®, Experian®, and TransUnion®. We identify negative items, reporting errors, and areas for improvement.

Step 3: Dispute & Repair

We initiate formal disputes on inaccurate or unverifiable items and communicate directly with credit bureaus, lenders, and collectors. Our team advocates on your behalf to correct and remove harmful items.

Step 4: Build & Monitor Progress

Credit repair doesn’t end with disputes. We help you establish healthy credit habits and offer progress tracking tools so you can see your credit score grow over time.

Credit Analysis Pricing & Next Steps

Once your free consultation is complete, the following steps need to be taken in order to start your credit report analysis. Pricing for our credit report analysis service is a one time fee of $277.99 and a $127.99 monthly fee thereafter. All documents referenced below can be uploaded through your portal under the “Account” tab.

Provide proof of SSN

Please gather 1 proof of your SSN. This can be an SSN Card, a W2, Tax Return. Anything with your full name and full social security number.

Provide Proofs of Address

Please gather 2 proofs of address. These can be a combination of a driver's license if current and a utility bill, or two utility bills.

Provide a copy of credit report

If you do not have a recent copy of your credit report, click on the link below to order a copy.

Service Options

Basic Credit Repair Plan

Our Basic Credit Repair Plan is ideal for individuals who need help addressing common credit issues such as late payments, collections, and charge-offs. We analyze your credit reports, file disputes on your behalf, and provide you with simple steps to improve your score. This plan is perfect for clients who are just getting started and want expert guidance at an affordable rate. It's a focused and effective path to begin your credit recovery journey.

Advanced Repair & Monitoring

For those looking for deeper credit repair plus ongoing support, our Advanced Repair & Monitoring package delivers the tools you need. Alongside professional disputes, you’ll receive monthly credit monitoring, customized financial coaching, and identity alerts. This package helps prevent future issues while tackling current problems. It’s ideal for clients who want to stay proactive and track their progress as they work to improve their credit score.

Identity Restoration Package

Victims of identity theft need more than just credit repair—they need protection and restoration. Our Identity Restoration Package includes full investigation of fraudulent items, disputes with bureaus, help with police reports, and steps to secure your identity. We also help you set up fraud alerts and freeze your credit if needed. Let us take the stress out of cleaning up identity theft while helping you rebuild your credit profile securely.

Results & Case Studies

At Global Credit, our clients have seen FICO score improvements ranging from 50 to 200+ points. From first-time homebuyers to individuals recovering from bankruptcy, our case studies show real results and long-term success. One client saw their score jump from 520 to 710 in just six months. Another had five collections removed within 90 days, allowing them to qualify for a car loan.

Our team is proud to have helped countless individuals repair bad credit and move forward with confidence. Every situation is different, and we’re committed to helping you achieve real, lasting credit improvement.