Empowering Our Clients Through Credit Education & Resources

Credit Education in St. Louis, MO – Learn How Credit Works

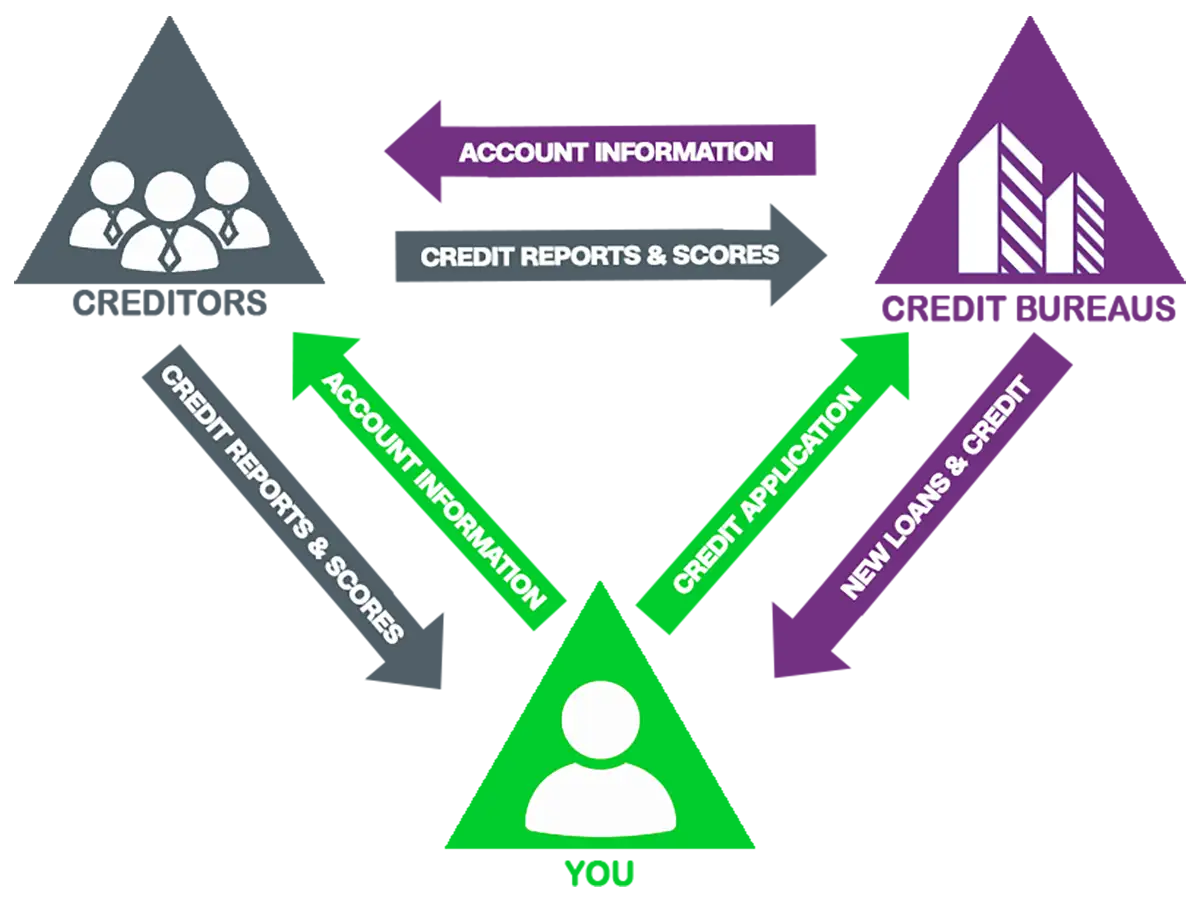

At Global Credit, we specialize in Credit Education in St. Louis, MO and beyond, helping individuals understand how credit works so they can take control of their financial future. Learning the fundamentals of credit is the first step toward long-term financial success.

Our team teaches clients in St. Louis and throughout the country how FICO scores are calculated and what actions have the biggest impact. Your credit score is based on five key factors: payment history, credit utilization, length of credit history, new credit inquiries, and types of credit used. Even a single missed payment or a maxed-out credit card can significantly lower your score.

Through our credit education programs, you’ll also learn how negative items like collections, bankruptcies, and charge-offs affect your credit profile—and how to recover from them. The more you understand your credit, the better prepared you are to build, manage, and maintain strong credit for life.

Credit Tips & Strategies

Managing credit card debt

One of the most common challenges our clients face is high credit card debt. Keeping your balances below 30% of your credit limit is one of the fastest ways to improve your credit score. At Global Credit, we provide personalized credit education and counseling in St. Louis, MO to help you create effective payoff strategies, reduce interest, and avoid the pitfalls of minimum payments.

Dealing with medical collections

Medical debt is a leading cause of credit problems nationwide. Our team educates clients on their rights, helps verify debts, and assists in negotiating with healthcare providers. With the right strategy, many medical collections can be disputed, settled, or removed before they damage your credit score long-term.

Navigating auto loan credit approval

When applying for an auto loan, your credit profile is one of the most important factors lenders consider. Our St. Louis credit education experts teach you how to prepare your credit file, time your application, and avoid excessive inquiries that may reduce your chances of approval or lead to higher interest rates.

Financial Literacy Resources

- We recommend trusted organizations like Money Management International, GreenPath Financial Wellness, and National Foundation for Credit Counseling (NFCC). These nonprofits provide free and low-cost counseling for budgeting, debt management, and financial education—making them excellent resources as you work to repair and rebuild your credit.

- Federal Trade Commision—Consumer Education Portal provides vital information on credit scams, fraud prevention, and how to file complaints. They also offer resources on how to freeze your credit and protect your identity if you’re at risk of fraud or theft.

- Recommended books & articles—Knowledge is power when it comes to credit. We suggest reading “Your Score” by Anthony Davenport for a deep dive into credit reporting, and checking out free online guides from Consumer Financial Protection Bureau. Articles like “How to Rebuild Credit After Collections” or “Credit Score Myths Busted” can help you take actionable steps today.

Tools

Free credit monitoring tool recommendations—We suggest using platforms like Credit Karma, Credit Sesame, and Experian’s free credit monitoring. These tools allow you to view changes to your report, track score trends, and receive real-time alerts on suspicious activity—all without affecting your score.

Global Credit is proud to be a trusted leader in Credit Education in St. Louis, MO—empowering our community with the knowledge and tools needed to achieve financial confidence and long-term credit success.